Mega-trends in the ATV Industry in 2008

The ATV industry—comprising youth, sport and utility vehicles—has matured into a multi-faceted, highly competitive business. Four-wheelers were once considered a child of the motorcycle industry, but they have now grown to surpass their 2-wheeled siblings in annual sales in North America.

Several key elements are shaping it in 2008:

Trail closures

The ATV industry is under an all-out assault from ‘anti’ groups that want quads and OHVs banned from public land. In a few cases, restrictions are warranted because of abuse and riders disrespecting the property of others. The vast majority of land closures, though, are punitive in nature. ATV Riders seem to be the victim of sheer bigotry. For example, on the Roseau River Wildlife Refuge in northwestern Minnesota, four-wheel-drive trucks continue to be allowed on some roads and trails, but off-highway vehicles have been banned completely from these same trails. No evidence was presented by the DNR that OHVs were causing more damage than trucks; they simply declared OHVs mechana non grata.

Honda Foreman EPS

ATVs are considered to be evil incarnate by environmental elitists simply because four-wheelers have an internal combustion engine and make noise. Green types are eager to post ‘No-ATVing’ signs everywhere possible whether damage is being done or not. Members of the non-riding public are disengaged from the realities of the debate and have no stake in the outcome. ATV riders, are not nearly as politically active as they should be.

This public relations imbalance means that millions more acres of public land are being closed to ATV use every year. We are witnessing the largest closure of public lands to legal users in history. More than 100 million acres of public forests in the United States are in the process of having OHV access closed or severely restricted. The same situation is occurring in Canada, where urban populations carry most of the clout in federal and provincial governments. When ATV advocates roll up their sleeves and get involved, though, good things happen. In some states, quad ‘parks’ are opening that will help maintain some public land riding opportunities. The Hatfield-McCoy trail in the American southeast is a stunning achievement earned by very hard work. But, overall, the trail closure tsunami rolls on, and there is no question that such massive closures are having a negative impact on businesses that rely on ATV sales. The manufacturers need to grow a lobbying group to ensure the future of the sport.

There is a silver lining in the cloud, at least for now. The saving grace for Polaris, Yamaha and other major brands has been UTV sales. The explosion in the UTV market has revealed an underestimated customer base: private land-owners. Many UTVs are not feasible or even legal to drive on public trails due to their width and weight. But farmers, ranchers and hunters love them because they can drive UTVs to places on their land that they wouldn’t dare to take their King Ranch Special Edition pickup truck. UTVs are the vehicle of choice for many weekend cowboys, gentleman farmers and construction workers. The growth in UTV sales has occurred so fast that it clouds the ability to predict the market saturation point. However, it is hard to envision UTV sales ever matching what ATV sales were at their historic peak, so private landowners will probably never replace the numbers of riders who once relied on public trails.

Technology advancements

Honda and Yamaha both added power steering to some of their 2007 ATV models. This announcement is the latest in a string of recent technology advances in the market. Fortunately for quad enthusiasts, there is no end in sight to this engineering binge. The age of the sparingly equipped 4-wheeler has passed. To compete in the ATV market today, an OEM must offer advanced, value-added features that address common consumer needs while still differentiating their models from the competition. The table below helps to show just how far ATVs have come since 4-wheeled ATVs were mandated by the CPSC in the mid-1980s:

| Legacy Technology | New Technology |

| Carburetion | Electronic fuel injection |

| Mechanical steering assemblies | Electric power steering |

| Incandescent tail/brake lights | LED tail lights |

| Manual-clutch transmissions | CVTs of various kinds |

| Straight rear axles | Independent rear suspension |

| Disc and drum brakes | Fluid shear brakes |

| Cable-driven mechanical speedometers | Electronic instrument clusters including GPS |

Advancements in ATV technology are following a trend similar to the automotive market. From the late 1970s to the 1990s, pickup trucks doubled in price and became loaded with more ‘techie’ features than most drivers can use. Likewise, the ATVs of today are becoming more and more feature-rich every year. If ATVs continue to follow the same trend as pickups, 4-wheeled quads loaded with advanced features and costing $10,000 or more will be on the market in the near future, and riders will eagerly part with their cash to have the latest and greatest technology. The advent of competition from China will help hold prices down, but more on this later.

Page 2

Gross annual ATV revenue exceeds $1 billion for the upper-echelon manufacturers. These companies fund extensive engineering departments with degreed specialists in every sub-area of the vehicle. Most consumers have no idea about the millions of dollars and thousands of man-hours that are expended to develop today’s new ATV platforms. One myth in the minds of some consumers is that the new technologies implemented on today’s quads are ‘borrowed’ from the automotive world. In theory this may be true, but in practical application there is no question that these technologies have been specifically developed as off-highway-vehicles.

Case in point: The EPS (Electric Power Steering) systems available on some Honda and Yamaha ATVs.

There are many technical challenges unique to ATVs that needed to be overcome to make this system work.

For starters, ATVs have historically had very limited magneto-based charging systems. EPS is continuously assisting steering effort by means of an electric motor, so it requires a lot of electrical power. Yamaha and Honda had to improve the output from their charging systems by about 20 amps to provide the extra juice. This was done with a stator, not an alternator, so none of this power increase was technology was borrowed from the automotive world.

Second, they had to develop an electronic control module that integrated power management and control logic to control the steering system safely. Each of these ATV families has custom electronics, such as Honda’s Electronic Shift Program. So the new Electric Power Steering had to be designed to be compatible with all their existing ATV technology, it could not be merely copied and pasted from a car, truck or motorcycle.

Third, EPS requires a combination potentiometer/steering torque sensor. The sensor reads the torque on the steering post and sends it to the ECU. When the rider turns the handlebars, the potentiometer tells the ECU which direction the rider wants to go. When the ECU detects torque on the steering post, it generates power in the EPS’ electric motor in the direction of the desired turn until the torque is no longer there, meaning the rider is satisfied with the new direction and is no longer moving the handlebars. Interestingly, the torque sensor also detects when steering feedback from the wheels (caused by a rut or obstacle in the trail) tries to force the quad in a different direction. Naturally, the rider resists the unwanted turning by gripping the handlebars. EPS senses this resistance to the torque and helps keep the quad going in the desired direction. The resulting improvement in steering ease and stability is remarkable.

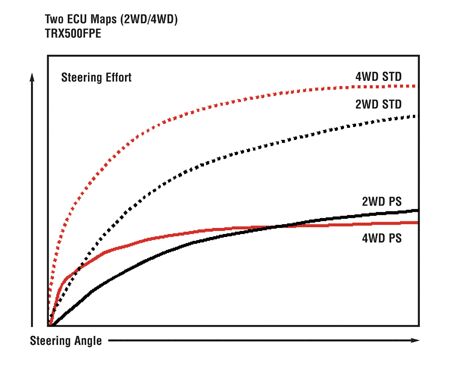

This graph from Honda illustrates the reduction in steering effort provided by the company’s EPS

Fourth, other components, including the geartrain and the drive motor itself, all need to fit within the packaging constraints, cost targets and severe environmental requirements that ATVs have.

Fifth, the system has a ‘safe mode’ that permits the steering to operate mechanically in the event of an electrical failure.

And last—because steering is critical to safety—the system was tested, tweaked and re-tested for thousands and thousands of test miles. EPS has been a critical technological development in the ATV market, the biggest breakthroughs are still to come.

The ‘Asian Invasion’

In the 1990s, nearly every major ATV manufacturer began to offer Youth ATVs in the 50 and 90cc class. The Big 7 tapped into inexpensive tooling and manufacturing by having these ATVs produced in Southeast Asia, while using their own testing facilities and personnel to validate the designs so they met some minimum performance and reliability standards. The result was annual unit sales in the tens of thousands with minimal investment. These development programs made OEMs a lot of money, but they also helped certain scooter manufacturers in SE Asia become more proficient at making quads. Later, some enterprising American importers recognized that SE Asian ATVs were getting better and they could still sell them at very low prices. As a result, more and more importers are offering Asian quads. These factors have awakened a sleeping giant. To be more precise, a new dragon has arrived on the ATV scene in this ‘Asian Invasion.’

Publicly, the Big 7 does not acknowledge the plethora of new challengers in the ATV business. But importers of Asian ATVs are hungry and working hard to deliver an acceptable product at a super price. Consequently, everyone in the ATV business is now operating in a hyper-competitive environment reminiscent of the snowmobile market in the early-to-mid 1970s. The hyper-competitive ATV market is trending toward several outcomes:

• Cost reduction pressure: Low-cost machines are coming from China and Taiwan that compete head-on with models from the Big 7 in engine classes lower than 500ccs. On models with 500ccs and up there is dogged price competition between the established brands. CEOs at all of the Big 7 probably worry more about cost today than any other aspect of their business. Cost reduction pressure is causing them to source more and more of their products in Southeast Asia or other lower-cost manufacturing regions such as Eastern Europe. The price pressure is also shrinking profit margins for OEMs and their suppliers.

• An industry-wide dilution of product and service quality. Southeast Asian newcomers are not party to the design standards that the Big 7 comply with. These standards are a sort of tribal knowledge that resulted from the belt-whipping the CPSC gave to three-wheeler manufacturers in the 1980s. Chinese and Taiwanese firms weren’t in the picture when the ‘consent decree’ on design standards came down, so today they build to their own specifications. The lack of a consent decree for Asian brands is only part of the product quality issue. The problem also involves inexperience in the market, and the American consumer’s desire for ultra-cheap goods. A select few who persevere and grow will overcome their inexperience. Following the automotive analogy again, Kia and Hyundai have, of course, dramatically improved their quality rankings and now offer competitive luxury models. The day is near when a few Southeast Asian quad builders such as Kymco will have an equal quality footing with the current industry icons, but the multitude of ‘me-toos’ will continue to pull the industry downward unless stricter standards are mandated for them.

Perhaps even more significant than a dilution of product quality is the dilution, or dissolution, of dealer and service quality. Many small ATVs are being sold as disposable, one-summer power toys with no service or support. ‘Ma and Pa’ dealerships take a double hit when a cheap ATV is sold by someone else to one of their potential customers—a loss of a vehicle sale and a loss on the service and parts afterward. Of course, this problem presents an opportunity for those who improve their service and support. Forward-thinking dealerships offer a superior service experience that helps them to retain their customers. Dealers offering ATVs at Asian prices with superior service will really cash in. Traditional ATV dealerships that do not provide superior service will continue to lose profit opportunities both to ‘lemonade stand’ ATV dealers and upper-echelon ATV shops.

• A weeding out of ATV manufacturers will inevitably occur. If the past is prologue, the snowmobile industry of the early to mid 1970s reveals what’s coming for four-wheeler companies. As overall ATV sales flatten out or decline, the increased pressure will force some out of the ATV marketplace. Most major ATV companies are reporting drops in quad sales. It might be surprising to see which companies say Uncle as the shakeout unfolds.

The end result of the Asian Invasion is that ATV products and services are becoming a commodity market. To win in this environment, quad builders must compete head-on on price, and differentiate themselves by offering a premium product and service experience. The Big 7 enjoy an advantage in premium features, but given the current economic conditions, they must maintain their price points. Premium features and brand loyalty are two major advantages enjoyed by the major OEMs over Asian imports. But loyalty only goes so far—ask Ford and Chevrolet. In today’s ATV business world, it really comes down to the value proposition. Whoever offers the best products at prices that customers can afford will win the marketshare war in the long term.

ATVs being offered as a tool platform

Approximately one-third of the current ATV market is farm/ranch/construction. Trail closures limit the growth of riding opportunities, but there will always be a demand for food, new homes and infrastructure. Therefore, ATV manufacturers are making vehicles that can be customized for utility applications from land surveying to golf course maintenance and everything in between. The term ATV is being used loosely in describing this mega-trend. In reality, off-highway vehicles (OHVs) that have many different legal and technical classifications are being used in these utility modes.

ATV designs are becoming increasingly modular. One example of this is Arctic Cat’s Speedrack system, which it developed to enable multiple accessory attachments for outdoorsmen. Doing this allows hunters and fishermen to easily customize their vehicle for their activity of choice. In fact, each of the Big 7 recognizes the growing demand for accessory use on ATVs and they are all developing modular accessory attachments to meet this need. Special rack designs, though, only shows the tip of the modular design iceberg. Companies such as Bobcat and Kubota are marketing entirely new vehicles—essentially motorized tool platforms—to provide solutions for the industrial market. Technologies such as CAN Busses, Mechanical Power Take Offs, hydraulic pump connections and joystick controls with graphic displays will continue to expand this new frontier for ATVs and UTVs. Look for more modular tool and accessory capabilities on ATVs and OHVs in the future.

These mega-trends are changing the ATV world. Industry players that are strategically visionary, technologically savvy and adapt their marketing strategies to changing consumer demands will have an advantage moving forward.

Gary Gustafson is president of G-Force Consulting, a company that provides design, marketing and industry analysis services to ATV, snowmobile and motorcycle manufacturers. http://www.g-forceconsulting.com/.

More by ATV.com Staff

![More ATVs on Ice [video]](https://cdn-fastly.atv.com/media/2022/10/24/8742964/more-atvs-on-ice-video.jpg?size=350x220)